It wasn’t even six months ago when marketers were scratching their heads trying to figure out how and when things might start returning to normal. What would it take to get consumers to start buying and behaving like they used to?

Today, as millions of Americans are being vaccinated against COVID-19 each week, we might at last have our answer. And that possibility is certainly reflected in Slingshot’s most recent consumer forecast.

Today, as millions of Americans are being vaccinated against COVID-19 each week, we might at last have our answer. And that possibility is certainly reflected in Slingshot’s most recent consumer forecast.

We surveyed 210 consumers on a variety of topics, and the insights are telling for marketers in most every consumer category.

Here are our top five takeaways:

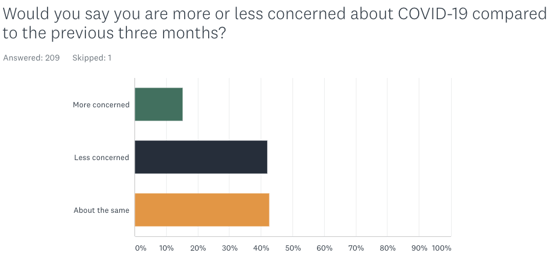

1. More consumers are feeling less worried.

Though concerns still exist among large portions of the population, consumers are showing less overall anxiety about COVID-19 than anytime in the past year. 45% of consumers are less anxious now about COVID-19 than they were at the start of the year, a trend certain to accelerate as the vaccine rollouts widen.

And while younger audiences show less concern than older audiences, the numbers are noteworthy across the board as people begin to feel more confident about getting out again.

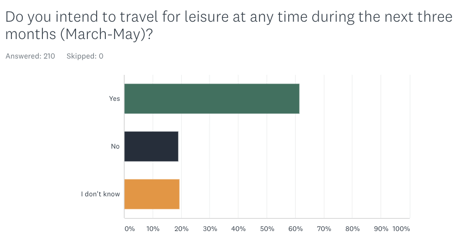

2. Travel intentions and travel budgets continue to rise.

After a year of consumers making fewer non-essential purchases, not only is there plenty of demand in certain sectors, there’s also the money to pay for it. For instance, in the travel sector, people who put off taking vacations during the lockdown are now eager to make up for lost time.

Travel intention is up a whopping 30% from the winter, with a full 60% of all respondents intending to take a leisure trip before summer. That’s great news for travel brands. What’s more, those numbers hold up across all age groups and income levels, pointing to some serious demand among consumers to get out of the house this spring.

Better yet for travel brands is that many of these consumers actually plan to increase their travel spending. 85% of respondents expect to spend more or the same amount as they did on their last trip, with only 15% expecting to spend less.

And there’s more good news for destinations: older audiences in particular are primed for longer trips, with more than half of travelers age 60 and older intending to travel for five nights or longer.

Casinos also appear primed for a comeback, with multiple respondents citing trips to Vegas or other gambling destinations for their next vacations. And while more people still intend to travel to destinations they’ve been to before, trips to new destinations are up over ten percent from the winter, suggesting more adventurous forms of travel may be in the offing this spring.

3. Hints of a brick and mortar comeback.

The desire to get out and spend more goes beyond travel. For example, the combination of the changing seasons and the continued vaccine rollout are driving more people back into restaurants, with intentions to dine out up 25% from the winter.

In fact, those who plan to dine out more often outnumber those who intend to scale back by nearly two to one. And among affluent audiences? A staggering 87% plan to eat out more often this spring.

But there’s a bigger story here, as people are also foregoing other services in lieu of more in-person experiences. Examples include:

- Six in ten consumers plan to start shopping less for groceries online

- 67% intend to shop in-person at grocery stores more often

- 40% intend to get back in the gym, up nearly 10% from the winter

Put it all together and what we see is an ever-increasing desire among more consumers to get back out in the world and enjoy more of the experiences they were forced to forego during the lockdown.

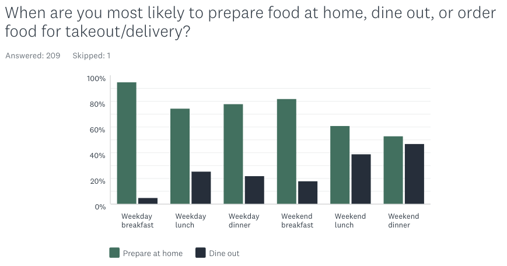

4. Weekends are the gateway to getting out.

As the following graph makes quite clear, diners are most likely to venture back out to restaurants during the weekend, with the lunch and dinner day parts leading the charge.

Retailers of all stripes should take note, as we believe this reflects a broader trend in the marketplace. Busy, time-strapped consumers, many of whom are still working from home, are most likely to venture out and spend more during the weekends when they’re off the clock.

5. Keep an eye on affluent segments.

While there is good news relating to consumer segments in all age and income groups, extra attention should still be paid to more affluent targets (HHI $175k+), especially as it relates to discretionary or elective spending. Not only is this the audience least impacted by the downturn, many also managed to save money over the past year as well.

In other words, they currently have the most cash to spend while also showing the desire to get out and spend it. Versus the general population, affluent audiences are:

- Up to 15% more likely to dine out on weekends

- 15% more likely to dine out at least once a week

- 16% more likely to take leisure trips of five nights or more

- 27% more likely to travel by air

- 11% more likely to stay at a resort

- 26% more likely to return to the gym or buy a membership

- Nearly 20% more likely to purchase exercise equipment

In other words, following the money might be the smartest way of all to boost business this spring.

Judging by this forecast, it appears that springtime might bring some sunny days to marketers who have been in the dark for much of the past year. And the best news of all may be what’s lurking behind these encouraging numbers: COVID-19 anxiety is still the number one thing keeping most consumers from shopping, buying, dining, and traveling. That means there’s still plenty of upside ahead, and we may only be seeing the tip of the iceberg when it comes to consumer demand. We’ll be keeping a close eye on all of these trends to see exactly which way the marketplace is headed come summer.